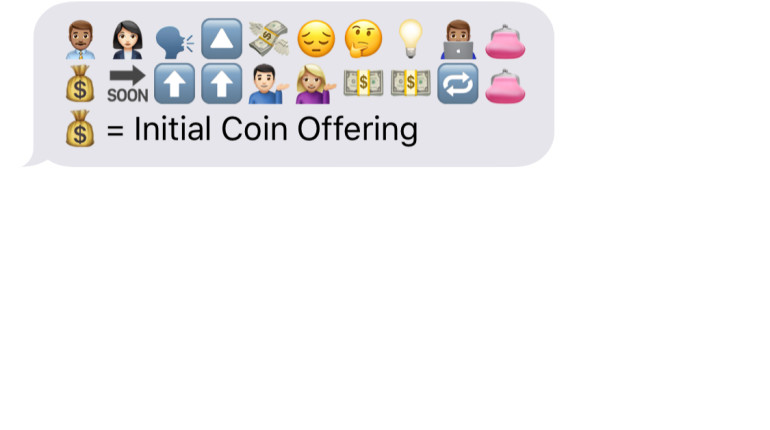

Let us break this down

1. You and your co-founder talk about raising money

2. You have not had much success

3. So you think one day and have an idea

4. To raise money by creating a cryptocurrency “coin” like Bitcoin

5. Soon you sell your currency to the public for capital

6. In exchange for your digital “coin”

7. This all equals an Initial Coin Offering (ICO)

Let us piece this together

You have been trying to raise money for your cryptocurrency company but have not had much luck, so one day you and your cofounder come up with an idea to raise money by creating your own digital currency also known as cryptocurrency coin or token. Soon you offer your currency to the public who buy your coins for a perceived value. The success you have raised money for your start-up!

What is ICO?

Initial Coin Offering is an unregulated form of raising money for cryptocurrency start-ups. This is used to bypass a lot of capital raising regulations and early backers are exchanged coins or other cryptocurrencies like Bitcoins for capital. Similar to an IPO (initial public offering) but instead of exchanging a stock interest in your company you are exchanging digital coins.

ICO 101

Initial Coin Offerings have become very popular this past year, and you might have heard about BitCoin or Ethereum who were some of the biggest ICOs to date. What usually happens is a cryptocurrency company puts a plan down on a whitepaper and states how much money they need to pursue their venture, similar to crowdfunding website Kickstarter. Key metrics they have to state are

• How many tokens the founders will keep

• What needs the company will fulfill

• How much money they need to raise

• How long the ICO will run for

Now just like Kickstarter if the cryptocurrency start-up fails to raise the stated amount of money needed for the specific amount of time then they must return any other capital raised and not have a successful ICO.

Essentially ICO’s is an IPO and a Kickstarter campaign behind as it raises money not from just investors, like a Kickstarter, but the backers are exchanged interest in the company like an IPO.

ICO Safe?

Just like an initial investment, ICO’s are built on speculation and early investors are motivated by the hopes that the start-up itself will become successful in its plan to turn their coin into a higher value. But like anything, this is speculation and considered high risk. One of the most successful ICO’s was Ethereum which raised $18 Million at a $0.40 valuation per an Ether (their coin name) and in 2016 it was reported to have a value of $14 per an Ether. Again we are pointing out the successful ICO, just like every positive, there are negatives where valuation have lost 50% within minutes Like we said these values are all based on speculation.

The Good The Bad The Ugly

• Disrupting technology that is changing the way currencies are views as well as how start ups can raise money (Good)

• This technology is so new and hard to place a true value on that the SEC does not regulate them and therefore the currency is essentially unstable (Bad)

• Since anyone can essentially create a cryptocurrency if you understand Blockchain and people have FOMO about missing out on great finds like Ethereum a lot of currency could fail and be ‘fake” (Ugly)