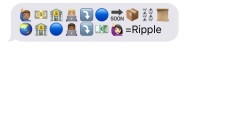

1. You hear some news come out about a company on the market

2. You tell your news to your friend, who in return, tells more people

3. Researchers look into the company and they start to notice the price swaying based on the news

4. Finally, you realize that all the information available to you is having a direct effect on the market price

5. And the stock price goes up and down based on the news out there

6. This all equals Market Efficiency

Let us piece this together

Some news comes out about a company and you tell some of your friends about this news, now they tell more people and finally researchers are looking into if the news is real or not. Finally, you realize that all this news is affecting the price of the stock as it goes up and down based on all the information that is out there in the market. This all equals Market Efficiency.

Market Efficiency 101

This is a theory that came about from Eugene Fama in the 1970s that states that is is impossible to outperform the market because all the available information on the company is already reflected in the stock price. What do you think?

Market is A Bunch Of Mean Girls

Remember in Mean Girls, how far rumors carried, and how much they destroyed or built up Gretchen, Regina, Cady, and Karen? "I saw Cady Heron wearing army pants and flip flops. So I bought army pants and flip flops." Well, unlike in high school where the topics consisted of who is getting fat, or who kissed who, the market rumors are about new products, how much profit X Company will make, or even scandals! #DRAMA

The smallest of rumors can boost or drop a stock if it gets enough traction. Investors act on these rumors, often to get ahead of the competition and stocks can waver because of it. Tesla, for example, experienced a drop when the rumor of some miss-accounting with their acquisition of Solar City, and when the rumor became true, the stock tumbled even more.

More recent, Snapchat has felt the effects of being a publicly traded company where rumors and celebrities can sway your market prices. Most recently the famous "Work" singer Rihanna tweeted her disgust to Snapchats reference to her domestic violence case with Chris Brown. This tweet helped lead to a loss of almost $800 Million. This comes a month after the youngest Kardashian star Kylie tweeted if anyone even uses Snapchat anymore, this wiped out about $1.3 Billion in a single day for $SNAP.

Investors always have their ears perked up waiting to get any information they can take to get a leg up on their competition and some even spread rumors to see who will act on them. It is like high school when you are always waiting to hear the juicy gossip but unlike a person, the juicy gossip here is about a company. It is up to you to act on the rumors if you want or wait until there is solid proof to back up the information

So Why Do We Care?

• If you believe in this theory, you are a more passive investor

• It is important to understand news can affect a stock

• You can leverage information or potential information to choose where you want to invest

Overall, if you believe in the theory or not, it is important to understand that there are external factors that can affect a stock's price, it just matters how much and when it does. As always, we want to educate you, and it's important to work with a financial professional that understands this and can help you navigate all the information that is out there.